The Ultimate Guide for First-Time Home Buyers in Northern Utah

Buying your first home is an exciting milestone, but it can also feel overwhelming. With so many steps, financial considerations, and decisions to make, it’s essential to go in prepared. If you’re looking to buy a home in northern Utah—whether in Salt Lake City, Draper, or anywhere along the Wasatch Front—this guide will walk you through everything you need to know to make the process as smooth as possible.

1. Assess Your Financial Readiness

Before you start looking at homes, take a close look at your finances. Here’s what you need to consider:

- Credit Score: A higher credit score can help you qualify for a better mortgage rate. Ideally, aim for a score of 620 or higher, but many loan programs cater to buyers with lower scores.

- Down Payment: Depending on your loan type, you may need anywhere from 3% to 20% down. First-time buyers often qualify for low or no down payment programs.

- Debt-to-Income Ratio (DTI): Lenders typically prefer a DTI below 43%, meaning your monthly debts (including your future mortgage) should not exceed 43% of your income.

- Closing Costs: Expect to pay 2-5% of the home’s purchase price in closing costs.

2. Get Pre-Approved for a Mortgage

Getting pre-approved is a crucial step before house hunting. A lender will review your financials and give you a pre-approval letter, which:

- Helps you understand how much home you can afford

- Shows sellers you’re a serious buyer

- Speeds up the closing process

In Utah, there are several loan options for first-time buyers, including FHA loans, VA loans (for veterans), and Utah Housing loans, which offer down payment assistance.

3. Find the Right Real Estate Agent

Having an experienced real estate agent—like Team Parsons—by your side can make all the difference. A good agent will:

- Help you find homes that fit your budget and needs

- Guide you through negotiations and contracts

- Connect you with trusted lenders, inspectors, and title companies

- Ensure you don’t overpay in this competitive market

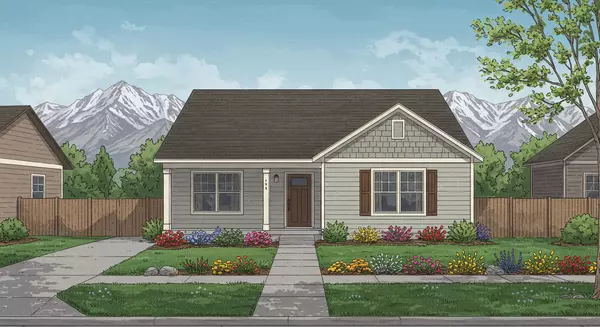

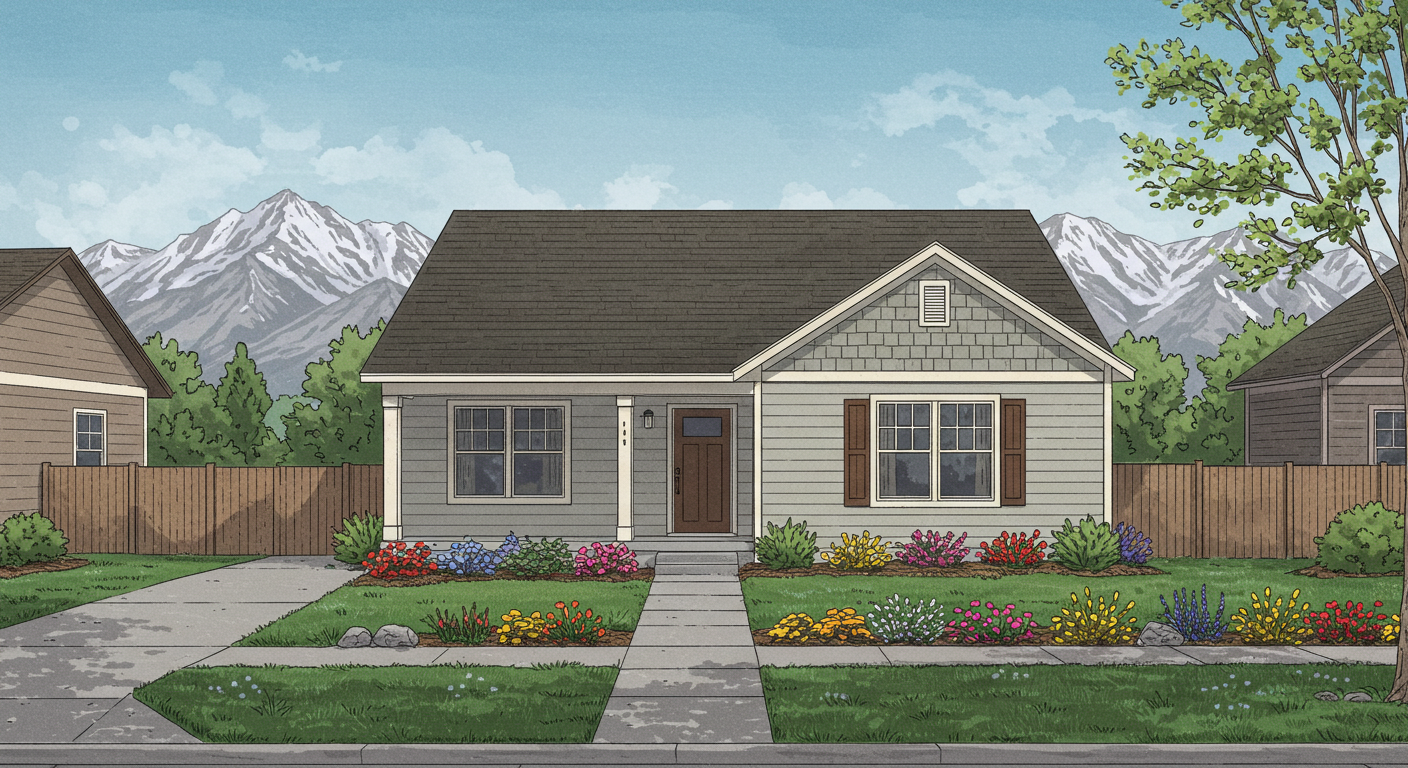

4. Start House Hunting

Once you’re pre-approved and working with an agent, the fun begins! When touring homes, consider:

- Location: Proximity to work, schools, shopping, and transportation

- Neighborhood: Safety, community vibe, and future resale value

- Condition: Pay attention to the age of the roof, HVAC system, plumbing, and electrical systems

- Size & Layout: Make sure the home meets your current and future needs

In northern Utah, demand can be high, so be prepared to act quickly when you find a home you love.

5. Make an Offer & Negotiate

When you find the perfect home, your agent will help you submit a competitive offer. Factors that affect your offer include:

- Current market conditions (buyer’s or seller’s market)

- How long the home has been on the market

- Whether there are multiple offers

Negotiations may involve price adjustments, seller concessions, or repairs. Your agent will help you navigate this to get the best deal possible.

6. Home Inspection & Appraisal

Once your offer is accepted, two critical steps happen:

- Home Inspection: A licensed inspector will check the home’s condition, identifying potential issues. If major problems arise, you can negotiate repairs or back out.

- Appraisal: Your lender will require an appraisal to ensure the home is worth what you’re paying. If it comes in lower than expected, you may need to renegotiate the price.

7. Closing on Your First Home

After the inspection and appraisal, you’ll move toward closing. Before signing the final paperwork:

- Review all documents carefully

- Do a final walkthrough of the home

- Bring your ID and any required funds for closing costs

Once everything is signed, you’ll get the keys to your first home!

Ready to Buy? Let’s Talk!

Buying your first home in northern Utah doesn’t have to be stressful. With the right preparation and guidance, you can navigate the process with confidence. If you’re ready to start your journey, Team Parsons is here to help! Contact us today, and let’s find the perfect home for you.

Recent Posts